Advanced Strategy Parameters

Volumes Strategy and Its Parameters

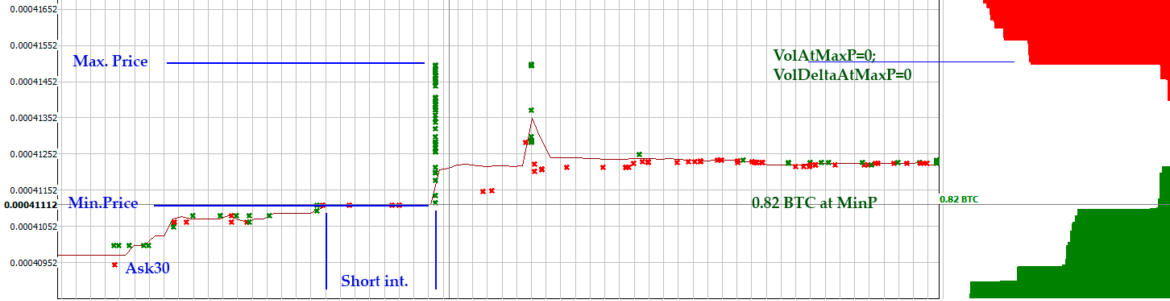

The essence of the strategy is volume detection. It defines two intervals: a short one and a long one, after which volumes are calculated for both intervals.

The volume over the long interval is normalized to one minute, i.e., converted into volume per minute. For example, if the long interval is set to 300 seconds (5 minutes) and the volume over 5 minutes is 10 BTC, then the volume per minute will be 10 / 5 = 2 BTC.

On the short interval, the volume is taken as is.

All volume ratios are specified as numbers indicating “how many times one is greater than the other,” not as percentages.

After the volume conditions are triggered, the second step checks the BID order book (green) and the ASK order book (red):

-

filling of the BID order book at 2 levels;

-

the minimum price level within the short interval;

-

the maximum price level within the short interval;

-

filling of the BID order book to a specified depth from the current price of the ASK order book. Comparison of the BID volume at the specified depth with the ASK volume at the specified height;

-

determining the dynamics of BID order book filling from the moment of detection at step 1 until the moment of order placement. The strategy waits no more than 20 seconds to verify the conditions; if the conditions are not met, the Buy order is not placed.

General Parameters

-

VolShortInterval: field for specifying the short interval time in whole seconds (minimum value 4 sec);

-

VolShortPriseRaise: field for specifying the price increase on the short interval in percent (can be set to 0);

-

VolLongInterval: field for specifying the long interval time in whole seconds (minimum value 120 sec);

-

VolBvShortToLong: field for specifying the ratio of buy volume (BV) on the short interval to the total per-minute volume on the long interval, i.e., how many times one exceeds the other;

-

VolBvLongToHourlyMin: field for specifying the minimum ratio of the normalized volume on the long interval to the normalized hourly volume;

-

VolBvLongToHourlyMax: field for specifying the maximum ratio of the normalized volume on the long interval to the normalized hourly volume;

-

VolBvLongToDailyMin: field for specifying the minimum ratio of the normalized volume on the long interval to the normalized daily volume;

-

VolBvLongToDailyMax: field for specifying the maximum ratio of the normalized volume on the long interval to the normalized daily volume;

-

VolBvToSvShort: field for specifying the BV to SV ratio on the short interval;

-

VolBvShort: field for specifying the minimum BV volume on the short interval, in the base currency;

-

VolBuyersShort: field for specifying the number of buyers on the short interval;

-

VolSvLong: field for specifying the maximum sell volume on the long interval, excluding the short interval, in the base currency;

-

VolTakeLongMaxP: YES/NO checkbox.

If YES is set, use the MaxPrice on the long interval. Useful in cases of false price growth after a drop; -

VolAtMinP: field for specifying the volume in the BID order book at the minimum price level on the short interval, in the base currency;

-

VolAtMaxP: field for specifying the volume in the BID order book at the maximum price level on the short interval, in the base currency;

-

VolDeltaAtMaxP: field for specifying the volume in the BID order book at the maximum price level on the short interval from the moment of detection until the Buy order is placed, in the base currency. The strategy waits no more than 20 seconds to verify the conditions; if the conditions are not met, the Buy order is not placed;

-

VolDeltaAtMinP: field for specifying the volume in the BID order book at the minimum price level on the short interval from the moment of detection until the Buy order is placed, in the base currency. The strategy waits no more than 20 seconds to verify the conditions; if the conditions are not met, the Buy order is not placed;

-

volBidsDeep: field for specifying the depth to which the BID order book should be analyzed, in percent from the current BID order book;

-

volBids: field for specifying the volume in the BID order book at the specified depth, in the base currency;

-

volAsksDeep: field for specifying the height to which the ASK order book should be analyzed, in percent from the current ASK order book;

-

volBidsToAsks: field for specifying the minimum ratio of BID volume to ASK volume at the specified depth and height.