Advanced Strategy Parameters

Waves Strategy and Its Parameters

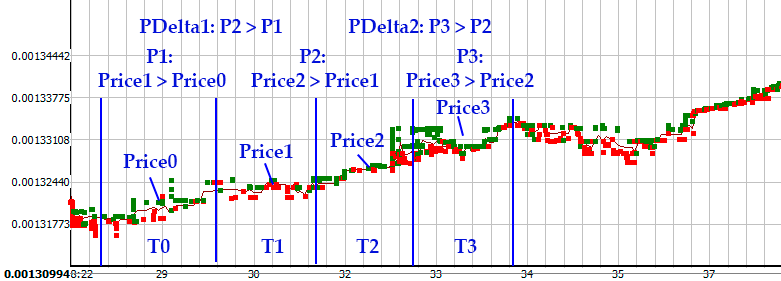

The essence of the strategy is volume detection. It defines 4 intervals and verifies that average prices and volumes increased from each previous interval to the next. Growth is specified in percentages. If 0% is set, the condition becomes “price (volume) did not decrease.”

To exclude the growth check for price/volume on a specific interval, you must enter a large negative value in the corresponding parameter. This will allow the condition check for that interval to always pass (except in rare cases of an actual price/volume drop below the specified value).

Designations: T — time intervals; P — prices; V — volumes.

General Parameters

-

WavesT0: field for specifying the time interval T0, in whole seconds (see figure above);

-

WavesT1: field for specifying the time interval T1, in whole seconds (see figure above);

-

WavesT2: field for specifying the time interval T2, in whole seconds (see figure above);

-

WavesT3: field for specifying the time interval T3, in whole seconds (see figure above);

-

WavesP1: field for specifying the minimum price change value P1 from the previous time interval T0 to the subsequent time interval T1, in percent. If a positive value is set, growth is checked. If a negative value is set, decline is checked. If 0 is set, not applied;

-

WavesP2: field for specifying the minimum price change value P2 from the previous time interval T1 to the subsequent time interval T2, in percent. If a positive value is set, growth is checked. If a negative value is set, decline is checked. If 0 is set, not applied;

-

WavesP3: field for specifying the minimum price change value P3 from the previous time interval T2 to the subsequent time interval T3, in percent. If a positive value is set, growth is checked. If a negative value is set, decline is checked. If 0 is set, not applied;

-

WavesDelta0: field for specifying the price change value on the zero interval: the difference between the maximum and minimum price within the zero interval T0, in percent. If a positive value is set, growth is checked (the measured delta is greater than the specified value). If a negative value is set, absence of growth is checked (the measured delta is not greater than the specified value). For example, “-1” means that the fluctuation was no more than 1%. If 0 is set, not applied;

-

WavesMaxSpike: field for specifying the maximum difference between the maximum price within the interval and the average price, in percent. Used to exclude spikes;

-

WavesV1: field for specifying the volume growth value from the previous time interval T0 to the subsequent time interval T1, in percent. If a positive value is set, growth is checked. If a negative value is set, decline is checked. If 0 is set, not applied;

-

WavesV2: field for specifying the volume growth value from the previous time interval T1 to the subsequent time interval T2, in percent. If a positive value is set, growth is checked. If a negative value is set, decline is checked. If 0 is set, not applied;

-

WavesV3: field for specifying the volume growth value from the previous time interval T2 to the subsequent time interval T3, in percent. If a positive value is set, growth is checked. If a negative value is set, decline is checked. If 0, not applied;

-

WavesWeightedAvg: YES/NO checkbox. Used for calculating average prices.

If YES is set, the volume-weighted average over the interval is used.

If NO is set, the average by number of trades over the interval is used; -

WavesReducedVolumes: YES/NO checkbox.

If YES is set, calculate volume per minute.

If NO is set, use the full volume over the interval.