Advanced Strategy Parameters

WallsDetection Strategy and Its Parameters

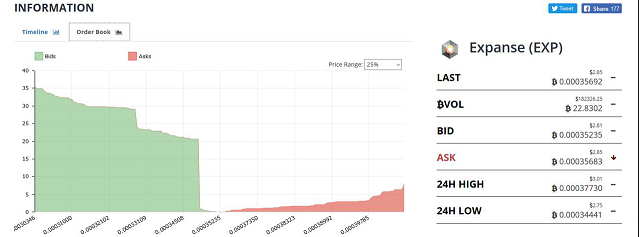

The purpose of this strategy is to identify coins that have a large buy-side order wall standing in the order book for an extended period of time. An example is shown in the illustration below.

By adjusting the parameters, you can define the time interval on which the wall should be detected. A typical sign of a long-standing wall is the absence of candle wicks below it — the price does not fall below the wall level.

It is recommended to set a small stop-loss just below the wall and check the news for the detected coin. In most cases, the presence of a wall combined with positive news is a sign of a potentially strong upward movement.

General Parameters

-

WallsMaxTime: a field for specifying the time interval, in whole seconds, over which candles are checked. The price-change delta begins to be evaluated within this interval;

-

WallsPriceDelta: a field for specifying the allowed deviation of candle wicks over the specified interval, in percent. The price must remain within this deviation for the time defined by WallsMaxTime. The goal is to determine how long the buy wall remains in place with minimal movement;

-

WallBuyVolDeep: a field for specifying the distance, in percent, between the current price and the buy wall in the order book. This parameter defines at what distance from the current market price the strategy will check for the wall volume;

-

WallBuyVolume: a field for specifying the minimum buy wall volume, in the base currency;

-

WallBuyVolToDailyVol: a field for specifying the minimum volume of the buy wall as a percentage of the daily trading volume for this coin.

Example:

if the daily trading volume is 100 BTC and the wall volume is 10 BTC, then the parameter must be set to at least 10% (10 / 100 × 100), otherwise the strategy will ignore this wall: -

WallSellVolToBuy: a field for specifying the sell-side wall volume. Its volume must be no more than X% of the buy-side wall volume. Of course, there may be no sell wall at all:

-

WallSellVolDeep: a field for specifying the distance, in percent, between the current price and the sell wall in the order book.

Example:

daily trading volume for the coin: 200 BTC. A buy wall of 50 BTC is standing 3% below the current price.

Strategy parameters:

✓ WallsMaxTime = 600 sec

✓ WallsPriceDelta = 1%

✓ WallBuyVolDeep = 3%

✓ WallBuyVolume = 50 BTC

✓ WallBuyVolToDailyVol = 10%

✓ WallSellVolToBuy = 30%

✓ WallSellVolDeep = 5%.

After the strategy is launched, it starts searching for coins where, at a distance of WallBuyVolDeep = 3% below current price, there is a buy wall with a volume of 50 BTC or more.

Next, this buy wall must be larger than WallBuyVolToDailyVol = 10% of the daily trading volume. In our case: daily volume = 200 BTC, Wall = 50 BTC (which is clearly more than 10%). Thus, the coin passes this filter and proceeds to the next step.

The strategy then checks the ASK side of the order book. If, at a distance of WallSellVolDeep = 5% above the current price, the sell volume is less than 50 BTC × 30% = 15 BTC, then the coin passes this filter as well.

Finally, if over the entire period of WallsMaxTime = 600 sec all the above conditions remain true and the price does not move more than WallsPriceDelta = 1% up or down, the strategy triggers.

⚠️ Important!

This example illustrates behavior based solely on the strategy parameters. The strategy still may not trigger if it does not pass the general filters that apply to all strategies (described earlier).